Bonk (BONK) has emerged as one of the standout performers in the crypto market in recent days. The token has posted gains of nearly 75% so far this year, drawing renewed attention from traders and investors.

At the start of 2026, the meme coin was trading around $0.00000750. Since then, price action has remained consistently bullish. Last Sunday (4), BONK printed a local top near $0.00001300, marking a sharp short-term rally.

The move unfolded alongside a broader recovery in the crypto market. Bitcoin (BTC) reclaimed the $90,000 level, helping restore positive sentiment. Still, while BTC and major altcoins posted more modest gains, BONK delivered far more aggressive price action.

That contrast raises an important question. Can the meme coin extend its rally, or is a corrective move now more likely?

Rising Demand Fuels BONK’s Latest Surge

BONK’s sharp rally did not happen in isolation. Over the past several days, meme coins have once again outperformed the broader market. Dogecoin (DOGE), Shiba Inu (SHIB), and Pepe (PEPE) have all posted strong gains in 2026. PEPE, for instance, jumped roughly 45% over the past weekend alone.

Within this environment, BONK managed to capture a significant share of speculative capital. Trading volume data highlights the shift clearly. Toward the end of 2025, BONK was averaging less than $50 million in daily volume. That picture has changed rapidly.

Over the past 24 hours, BONK’s trading volume surged past $750 million, according to CoinGecko data. When volume expands during an uptrend, it often acts as a catalyst. Higher liquidity reduces friction and allows price to move more freely. At the same time, aggressive buying pressure tends to accelerate rallies.

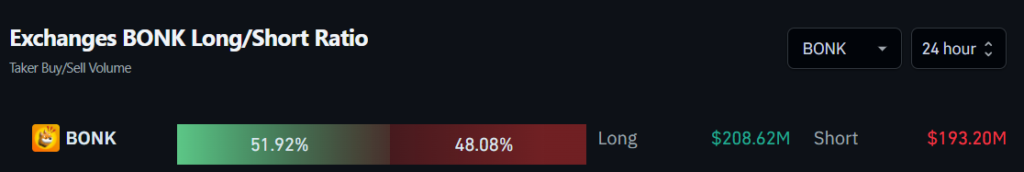

Data from Coinglass supports this view. Buy-side flow for BONK has consistently exceeded sell-side pressure across major exchanges. In the last 24 hours alone, buy orders outweighed sell orders by more than $10 million.

If this imbalance persists, BONK could continue pushing toward higher levels. However, such rapid advances also increase downside risk. The faster the rally, the greater the probability of a short-term corrective pullback.

Technical Analysis Warns of a Potential Pullback

Despite the upbeat sentiment surrounding meme coins, technical indicators call for caution. The first warning sign comes from the RSI, which has already moved above the 70 level. In many cases, readings above this threshold precede corrective moves.

This scenario gains traction if BONK begins to lose key technical levels. The most critical zone sits at the 0.236 Fibonacci retracement, located at $0.00001171. A sustained move below that level would increase the likelihood of a deeper correction.

In that case, price could revisit the 0.5 and 0.618 Fibonacci retracements. Such a move would translate into a decline of up to 20% from current levels. While negative in the short term, this type of pullback would be technically healthy.

A 30% Rally Is Still Possible?

On the other hand, a more constructive scenario remains in play. If BONK manages to hold above the 0.236 Fibonacci support, the broader uptrend could remain intact.

Under this setup, the meme coin may target the next resistance near $0.00001540. Reaching that level would represent an additional upside of roughly 30% from current prices.

As a result, the coming days are likely to be decisive. Volatility should remain elevated across the meme coin sector. Traders and investors should proceed with caution and apply strict risk management, as sharp swings are likely to persist.

BONK can extend its rally if buying pressure remains strong. However, elevated RSI levels suggest short-term volatility and possible pullbacks.

BONK benefited from renewed meme coin demand and a sharp surge in trading volume. Strong buy-side flow also supported price momentum.

The $0.00001171 level is a crucial support. Holding above it keeps upside targets in play, while a break below could trigger a deeper correction.