After a strong start to the year, Bitcoin (BTC) has begun to lose short-term momentum. The largest cryptocurrency is heading into its third consecutive daily decline and slipped back below the $90,000 level on Thursday (8).

At the time of writing, Bitcoin was down 2.2% on the day, trading at $89,761, according to CoinGecko data.

With this pullback, BTC has already given back more than half of its gains accumulated in 2026. Since reaching its yearly high of $94,800 on Monday (5), the asset has fallen by over 5%, reinforcing growing uncertainty among market participants.

Against this backdrop, technical signals and on-chain data offer important clues about what may come next.

Bitcoin fails at $95,000 and resumes downward move

Bitcoin has remained under pressure since Tuesday (6), when it failed to break above the $95,000 resistance zone. That rejection marked a clear shift in short-term structure, invalidating the recent bullish continuation attempt.

As a result, price action has reverted to a broader consolidation range, defined by resistance near $95,000 and support around $84,600.

From here, Bitcoin may revisit the lower boundary of that range. A move toward $84,600 would imply an additional downside of roughly 5.5% from current levels. This scenario remains firmly on the table as long as buying interest stays muted.

Technical indicators support this bearish bias. The daily RSI is hovering close to slipping below the neutral 50 level, a development that often signals weakening momentum and growing seller dominance.

At the same time, the four-hour chart paints a similar picture, with Bitcoin forming a clear sequence of lower highs and lower lows.

Momentum indicators also reinforce this setup. The 9-period exponential moving average has crossed back below the 21-period EMA, a configuration widely viewed as a short-term bearish reversal signal. Many traders treat this crossover as a sell trigger, especially in range-bound or corrective environments.

Notably, the last time this bearish crossover occurred, Bitcoin quickly dropped toward the $87,000 area. That level is now back on the market’s radar and could be tested again if buyers fail to step in with conviction.

On-chain data suggests selling pressure may persist

Beyond price charts, on-chain metrics also point to a challenging short-term outlook for Bitcoin. One closely watched indicator, the Coinbase Premium Index, remains firmly in negative territory. This metric tracks the price difference between Bitcoin on Coinbase and other major global exchanges.

A negative Coinbase Premium typically signals stronger selling pressure from U.S.-based investors, particularly institutional players who dominate volume on the platform. In practice, this suggests reduced demand and a more defensive stance from one of Bitcoin’s most influential investor groups.

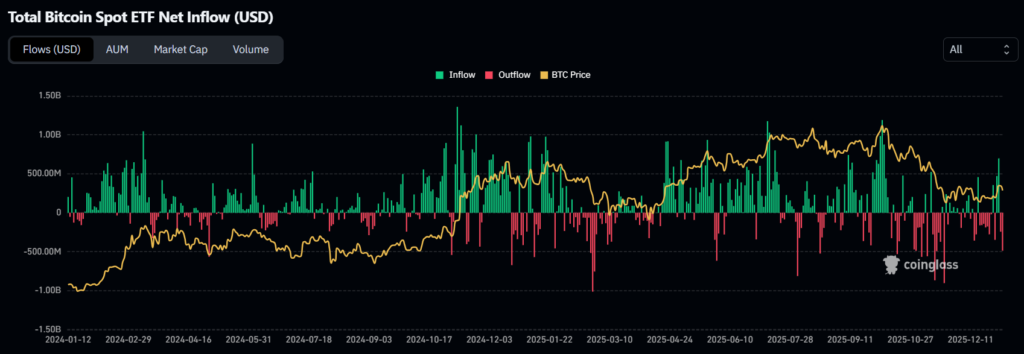

Institutional caution is further reflected in ETF flows. Spot Bitcoin ETFs in the United States recorded net outflows of approximately $730 million over the past 48 hours, according to data from Coinglass.

Such sustained outflows often translate into additional selling pressure in the spot market, as ETFs represent a major source of liquidity and demand. When institutional flows turn negative, the market tends to struggle holding key technical levels.

In conclusion, Bitcoin is navigating a fragile phase in the short term. With critical supports now in focus, the market is closely watching for signs of stabilization or confirmation of a deeper corrective move.

Bitcoin shows short-term weakness, but it remains within a broader consolidation range. A confirmed breakdown below $84,600 would strengthen the bearish case.

The $95,000 zone acts as a key resistance. Rejection at this level invalidated the recent bullish continuation attempt and shifted momentum lower.

ETF outflows reduce institutional demand and liquidity. Sustained withdrawals often increase downside pressure and weaken key support levels.