Cardano (ADA) is trading lower this Tuesday (23), as technical patterns suggest that further downside may still lie ahead if a key support level breaks.

According to CoinGecko data, the altcoin has fallen 5% over the past 24 hours. As a result, ADA remains locked in a broader bearish structure that has persisted for weeks. Over the last 70 days, the asset has recorded an accumulated decline of nearly 50%.

For now, the only realistic hope for a trend reversal appears to rest with whales. Below, we examine how their actions could help prevent a sharp sell-off in the coming days or weeks.

Chart Pattern Signals Up to 40% Downside for Cardano

Cardano has been trading within a descending wedge pattern since October 14. Since then, the price has continued to print lower highs and lower lows.

This structure reflects sustained control by sellers. Moreover, in recent weeks, ADA has failed to stage rallies strong enough to even test the upper resistance of the pattern.

That behavior highlights weakening buyer strength in the short term. As a result, the likelihood of another test of the wedge’s support line continues to rise.

Currently, that support sits near the $0.22 level. A move toward this zone would represent a drop of roughly 40% from current prices.

Before that scenario unfolds, however, an even more critical level comes into play. The $0.35 support has become decisive in the near term. If this level breaks, downside risks would increase significantly.

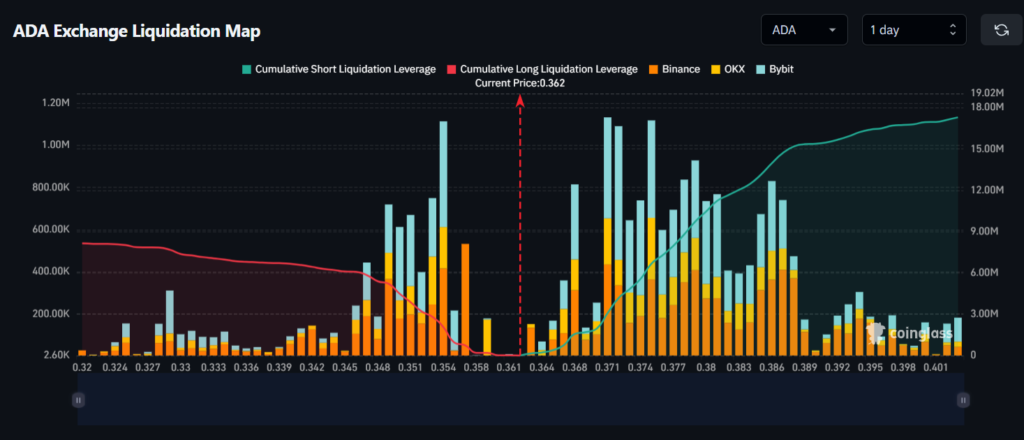

This price zone is not only technically important. It also concentrates a large amount of leveraged ADA positions.

According to Coinglass liquidation data, the majority of long futures positions would be wiped out if ADA falls below $0.35. Such a move could trigger a long squeeze. In this scenario, leveraged buyers are forced to close positions, rapidly increasing selling pressure. Consequently, price declines tend to accelerate.

Technical Indicators Reinforce Short-Term Bearish Bias

The short-term outlook further adds to the pessimism surrounding Cardano. On the 4-hour chart, ADA is consolidating within a narrow range between $0.35 and $0.38.

However, price action remains close to the lower boundary of this range. For that reason, a downside breakout appears more likely than an upside move.

Technical indicators reinforce this risk. The Relative Strength Index (RSI) remains below the 50 level, signaling continued loss of bullish momentum.

At the same time, the MACD has printed a bearish crossover in recent hours. This signal often points to the beginning or continuation of corrective moves.

Taken together, these indicators favor further downside. Until momentum metrics show improvement, bearish pressure is likely to persist.

Whales Emerge as the Last Line of Defense

Amid the growing number of negative signals, whales stand out as the primary hope for a potential reversal in Cardano.

Santiment data shows notable accumulation among large holders. Wallets holding between 100 million and 1 billion ADA have purchased roughly 100 million tokens over the past three days.

This behavior represents a positive signal. Whales carry significant influence over market dynamics. In many cases, their accumulation precedes major price movements.

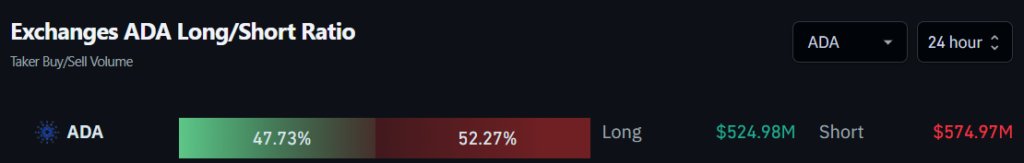

Still, this activity has not been enough to shift the broader outlook. Order flow data from exchanges remains unfavorable.

According to Coinglass, ADA sell orders exceeded buy orders by approximately $50 million over the past 24 hours. This imbalance continues to weigh on price action.

As a result, unless whales significantly ramp up their buying activity, downside risks remain elevated. If the $0.35 support level breaks, Cardano could be headed for a particularly weak finish to the year.