After fresh price declines, Ethereum is attempting to stabilize. The asset has dropped more than 40% over the past three weeks, reflecting a period of heightened risk aversion across the market. Even so, several indicators suggest the cryptocurrency could retest the $2,000 level.

Market participants are now watching mixed signals from different holder groups. Large investors, often referred to as whales, have resumed accumulation. Meanwhile, short-term traders continue to sell into recent price weakness.

As a result, the key question remains unresolved. Can Ethereum establish a higher low, or will another wave of selling pressure take control?

Whale Accumulation Points to a Shift in Market Dynamics

Recent data from Santiment points to renewed accumulation among large Ethereum holders. Wallets holding between 1 million and 10 million ETH have returned to buying activity following the sharp correction seen in recent weeks.

Since February 9, this group has accumulated more than 1 million ETH. At current prices, that translates into roughly $2 billion in capital deployed. This behavior suggests a more constructive stance from major market participants.

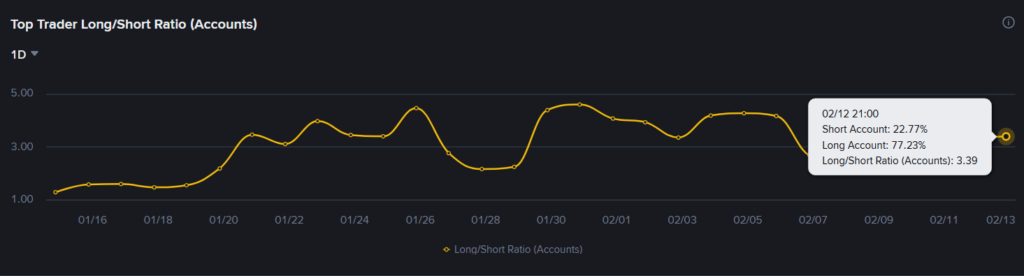

A similar trend has emerged in the derivatives market. On Binance, the share of large traders holding long positions in ETH futures has climbed above 77%. This increase reflects stronger appetite for directional exposure.

These signals matter because whales exert significant influence over market dynamics. Their capital can reshape liquidity conditions. In addition, they often operate with longer-term and more strategic perspectives.

When large holders accumulate during periods of weakness, the market typically interprets it as a sign that selling pressure may be nearing exhaustion. Still, this does not eliminate short-term risks.

Ethereum Price Tests Key Support as Sellers Push Back

From a technical perspective, Ethereum is trading within a critical zone. The $1,900 area now serves as immediate support. As long as buyers defend this level, a move toward $2,000 remains possible.

If that scenario unfolds, Ethereum could form its first higher low in roughly 30 days. This structure often signals the early stages of a trend reversal or, at minimum, a more sustained corrective bounce.

Momentum indicators support this view. The Relative Strength Index is hovering near the 30 level. Historically, readings around this zone indicate that selling pressure is becoming saturated. As a result, the risk of further downside tends to diminish in the short term.

However, on-chain data presents an important counterweight. The Spent Coins Age Band metric for coins aged between 7 and 30 days has surged by more than 650% since February 9.

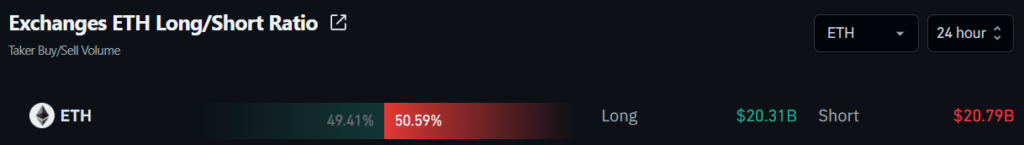

Put simply, short-term traders are actively exiting positions. This behavior has directly influenced order flow. Over the past 24 hours, sell-side volume exceeded buy-side volume by nearly $500 million across major exchanges.

As long as selling pressure remains dominant, upside moves are likely to face resistance. Consequently, the market continues to operate in a fragile equilibrium.

For now, caution remains warranted. Ethereum is showing signs of technical relief, but opposing forces are still in play. The next phase will depend on which group ultimately gains control of market momentum.

Ethereum price has been pressured by lower trading activity and aggressive selling from short-term traders following recent market declines.

Yes. Data shows large holders accumulating ETH, suggesting confidence at current price levels.

The $1,900 support and the $2,000 resistance are the most important levels shaping short-term price action.