Hyperliquid (HYPE) started the week on a positive note. However, that momentum may fade quickly due to a key event scheduled for this Monday (5).

Earlier today, HYPE printed a local high at $27.40, marking its highest price in three weeks. The move came alongside a broader market recovery.

Bitcoin (BTC) reclaimed the $90,000 level, triggering renewed strength across several altcoins. HYPE followed that trend, delivering solid performance.

Since Friday (2), the token has gained roughly 12%. Still, a specific factor could shift sentiment in the coming hours. A large token unlock is set to take place today, and it may significantly impact short-term price action.

Token Unlock Could Increase Selling Pressure on HYPE

Token unlocks are a common feature of many crypto projects’ tokenomics. In simple terms, these events release previously locked tokens to investors, team members, or partners.

In most cases, unlocks increase the circulating supply. When supply rises, prices often come under pressure. This happens because recipients may sell part of their allocation to lock in profits.

In Hyperliquid’s case, the size of the unlock stands out. According to data from Tokenomist, 12.46 million HYPE tokens will be released this Monday. At current prices, that amount is worth roughly $320 million. Such a figure can materially increase short-term selling pressure.

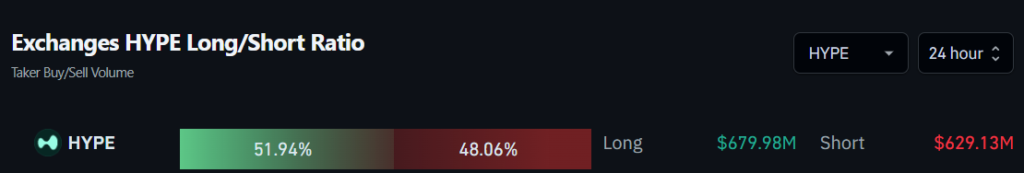

So far, buyers remain in control across exchanges. Buy orders have exceeded sell orders by more than $50 million over the past 24 hours, according to Coinglass data. This imbalance signals strong demand.

However, HYPE’s recent history calls for caution. The token has struggled after large unlocks in the past.

The most recent event took place on November 29, 2025. At that time, the release of more than $340 million worth of tokens triggered a sharp 15% decline in just two days.

Given that precedent, a similar reaction cannot be ruled out this time.

Technical Setup Points to a Potential Short-Term Pullback

From a technical perspective, HYPE is approaching a critical moment. The token is testing the upper boundary of its current consolidation range, between $22.55 and $27. Still, recent price action suggests caution, as the $27 level may once again act as resistance.

This risk becomes more pronounced when combined with the upcoming token unlock. If resistance holds, price could rotate back toward the lower end of the range. Such a move would represent a decline of roughly 15% from current levels.

On the four-hour chart, two signals reinforce the bearish short-term bias. First, the 200-period exponential moving average (EMA) has once again capped price advances. In addition, its interaction with the 50-period EMA suggests the broader trend remains bearish.

Bollinger Bands also add to the picture. They show recent compression and limited room for immediate upside. This setup often precedes sharper moves.

As a result, if buyers fail to absorb the supply shock from the token unlock, selling pressure could intensify. In that scenario, the week ahead is likely to bring heightened volatility, with price corrections becoming increasingly likely.

HYPE faces a large token unlock that may increase circulating supply. Past unlocks have triggered sharp sell-offs.

Token unlocks raise available supply. If demand fails to absorb it, prices often come under pressure.

The $27 area acts as key resistance. A rejection there could push price toward the lower end of the consolidation range.