Pepe (PEPE) trades higher this Wednesday (11), posting a short-term recovery. The asset bounced after touching an intraday low at $0.00000350. Since then, price has gained roughly 4%.

Even so, the broader macro structure remains under pressure. The recent market-wide sell-off weighed on most altcoins. As a result, PEPE still shows losses across higher timeframes.

However, several signals now draw trader attention. On-chain data points to strategic positioning by large holders, commonly referred to as whales.

The key question remains straightforward. Can whales sustain a fresh upside push this week, or will macro conditions continue to cap any stronger recovery?

PEPE Price Action Faces a Technical Inflection Zone

PEPE has remained in a downtrend since the second week of January. Since then, the token has dropped more than 55%. That move pushed price toward an annual low at $0.00000310.

This level now stands as the primary structural support. Bollinger Bands show price compression near this zone. Therefore, the market may find short-term protection against sharper downside moves.

Meanwhile, the $0.00000350 level has gained immediate relevance. If price holds above this area, a higher low could form. From a technical perspective, this pattern often signals the early stages of a trend reversal.

If confirmed, the next technical objective aligns with the Bollinger Bands’ midline near $0.00000430. Such a move would represent an upside of nearly 20% from current levels. Still, that region is also likely to act as a key resistance.

On the downside, a breakdown below $0.00000310 would reinforce the bearish structure. In that scenario, price could seek fresh liquidity zones below the annual low. Therefore, defending this support defines the near-term outlook.

In short, PEPE trades at a decisive technical area. Holding above $0.00000350 favors a corrective rebound. Losing $0.00000310, however, would likely extend the prevailing downtrend.

On-Chain Signals Show Whales Positioning for PEPE

On-chain metrics reinforce a notable dynamic. Despite macro headwinds, large wallets continue to accumulate. According to Santiment, the top 100 PEPE wallets added approximately 23.02 trillion tokens over the past four months.

This accumulation followed the broader market liquidation seen in October. Historically, whale activity often plays a decisive role in altcoin trend shifts.

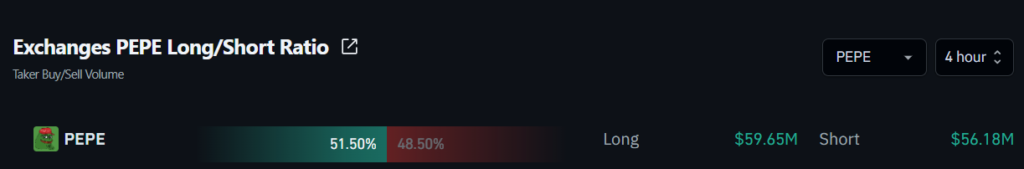

In addition, Coinglass data highlights a recent change in order flow. Over the past 24 hours, more than 51% of recorded orders were sell-side. However, during the last four hours, 51.6% of orders shifted to the buy side.

This short-term flip suggests growing buying pressure. Therefore, signs point to a coordinated attempt to stabilize price. If this flow persists, bulls could test nearby resistance levels.

Still, caution remains warranted. Last Thursday (5), PEPE dropped 20% during a sharp market-wide dump. That move underscores the token’s sensitivity to broader risk sentiment.

Thus, while whale accumulation strengthens the reversal narrative, macro risk continues to limit optimism. Sustained buying must overcome entrenched sell-side pressure. If both forces align, PEPE may begin a more durable recovery. Otherwise, elevated volatility is likely to persist.

PEPE is rebounding after holding a key intraday support near $0.00000350. Short-term buying pressure and whale accumulation are contributing to the recovery attempt.

The main support sits at $0.00000310, the annual low. Holding above $0.00000350 could allow a higher low to form, while resistance emerges near $0.00000430.

On-chain data shows sustained accumulation by large wallets and a recent shift toward buy-side dominance. However, broader market conditions still pose downside risk.